RAM Conservative

Individually Managed Accounts...

RAM Management Group's Managed Risk Trading Program 1X employs a technical and rules-based trading strategy. The program utilizes multiple components...

RAM Aggressive

Offering 3x leverage program...

The RAM Aggressive Program entry and exit levels mirror the Conservative program, however position size is three times that of a similar account traded pursuant to...

RAM Fund, LLC

Limited liability offering 3x...

The RAM Fund, LLC invests directly in the RAM Aggressive Program. It offers a leverage version of our program in a limited liability structure. This fund is privately offered...

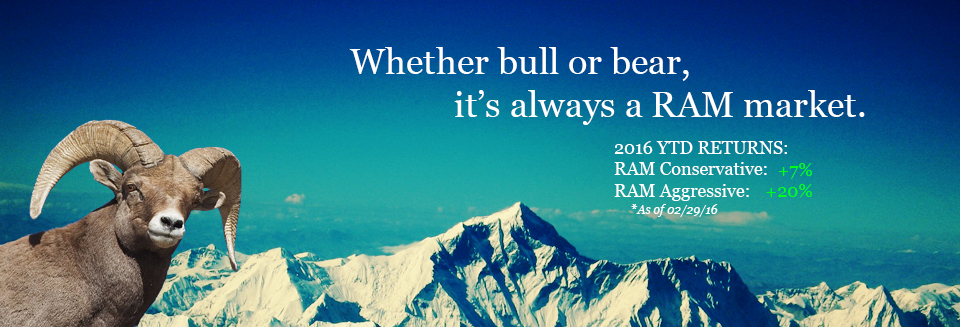

Welcome to RAM Management Group, Ltd.

RAM Management Group, Ltd is a registered CTA and CPO with the CFTC and member of the NFA for over 20 years. RAM executes a quantitative investment model with a sound comprehensive risk management philosophy utilizing exchange traded, liquid, centrally cleared, transparent, daily marked-to-market futures contracts. RAM's management team, comprised of veteran floor & off-floor futures traders each with over 20 years trading experience, believes in a rule-based technical investment model using a strength/weakness, highly selective breakout, short-to-medium term trend analysis system to go long or short, in over 30 futures markets across 7 economic sectors. RAM's returns and low correlation to stocks, bonds, hedge funds and many CTA's are due to its selective trade strategy which allows for avoiding duplicative positions (10% of the time RAM has no positions and generally has exposure to less than 6 markets simultaneously) and its shorter term nature of identifying strength or weakness at the portfolio level utilizing price and volatility studies. Money management includes sizing trades based on recent volatility, rather than simply price, limiting market exposure, and using hard stop-loss exits along with rule-based exits based on stage of trade and correlation of markets.

Contact Us

RAM Management Group, Ltd.

16 Forest Street

New Canaan, CT 06840

Tel (203) 972-1000

Fax (203) 972-8007

Info@RAMFutures.com